south dakota vehicle sales tax calculator

To know what the current sales tax rate applies in your state ie. Tax and Tags Calculator.

Sales Use Tax South Dakota Department Of Revenue

0 through 9 years old.

. South Dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1814 on. Municipal Sales Tax or Use Tax. Saving money on registration costs check out the Savings Estimate to see just how much you can save.

South Dakota all you need is the simple calculator given above. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. Benefits of registering your vehicles in South Dakota.

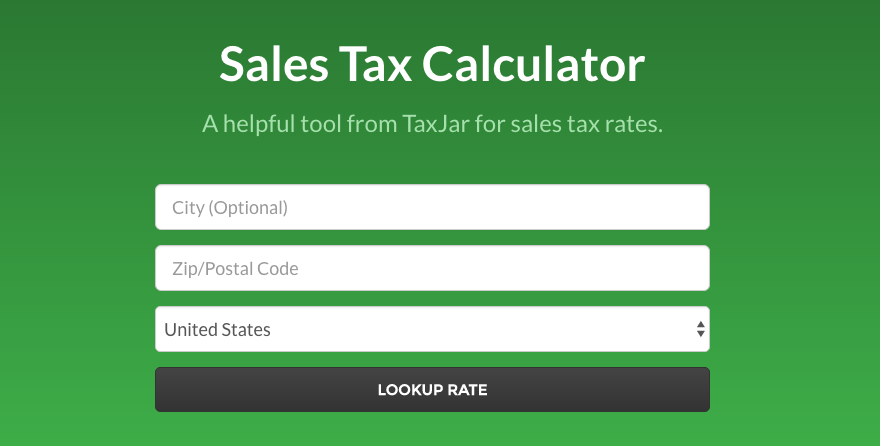

The state in which you live. If you are unsure call any local car dealership and ask for the tax rate. South Dakota Sales Tax Calculator You can use our South Dakota Sales Tax Calculator to look up sales tax rates in South Dakota by address zip code.

South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. How to calculate sales tax on a car in South Dakota You can use the sales tax rate calculator on the South Dakota Department of Revenue website to determine the total sales tax based on the dealerships address.

Mobile Manufactured homes are subject to the 4 initial registration fee. There are no personal property or luxury taxes on RVs. The Motor Vehicle Division provides and maintains your motor vehicle records.

The county the vehicle is registered in. For additional information on sales tax please refer to our Sales Tax Guide PDF. Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied.

You can use our North Dakota Sales Tax Calculator to look up sales tax rates in North Dakota by address zip code. Our online services allow you to. There are no mandatory vehicle inspections.

With local taxes the total sales tax rate is between 4500 and 7500. Purchase Location ZIP Code -or- Specify Sales Tax Rate. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

New car sales tax OR used car sales tax. However the buyer will have to pay taxes on the car as if its total cost is 12000. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Choose the Sales Tax Rate from the drop-down list. 45 The following tax may apply in addition to the state sales tax. Purchase new license plates.

Registrations are required within 45. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. South Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Moral issues in society today. Enter the Amount you want to enquire about.

Municipalities may impose a general municipal sales tax rate of up to 2. In South Dakota an ATV MUST be titled. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Thus a 12000 car may have a 1200 cash rebate. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

Find your South Dakota combined state and local tax rate. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. Whether or not you have a trade-in.

South Dakotas taxes on vehicle purchases are applied to the sale price before rebates or incentives. The state sales and use tax rate is 45. The type of license plates requested.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to South Dakota local counties cities and special taxation districts. Ad Lookup Sales Tax Rates For Free. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

Interactive Tax Map Unlimited Use. From there you can apply that percentage to your dream vehicles price to get a sense of the total purchase price. This is the case even when the buyers out-of-pocket cost for the purchase is 10800.

The Lead South Dakota Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Lead South Dakota in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Lead South Dakota. The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments. Your household income location filing status and number of personal exemptions.

Review and renew your vehicle registrationdecals and license plates. The South Dakota vehicle registration cost calculator is only an estimate and does not include any taxes fees from late registration and trade in fees. You may not owe South Dakotas 4 excise tax if you paid at least a 4 tax in another state.

All fees are assessed from purchase date regardless of when an applicant applies for title and registration. The South Dakota Department of Revenue administers these taxes. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to South Dakota local counties cities and special taxation districts. 4 State Sales Tax or Use Tax Applies to all sales or purchases of taxable products and services. South Dakota Sales Tax.

North Dakota has a 5 statewide sales tax rate but also has 214 local tax. Opt-in for email renewal and general notifications. Find out the estimated renewal cost of your vehicles.

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

The Consumer S Guide To Sales Tax Taxjar Developers

Sales Use Tax South Dakota Department Of Revenue

Car Sales Tax In South Dakota Getjerry Com

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Use Tax South Dakota Department Of Revenue

Vehicle Registration Cost Calculator South Dakota

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Use Tax South Dakota Department Of Revenue

States With No Income Tax Explained Dakotapost

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Vehicle Registration Cost Calculator South Dakota

Sales Use Tax South Dakota Department Of Revenue

South Dakota Vehicle Registration Vehicle Registration Services Dakotapost

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Sales Tax On Cars And Vehicles In South Dakota

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue